Home bias, as the name suggests, is the tendency for investors to favour domestic investments over foreign investments. Naturally, people feel more comfortable investing in what is familiar and close to home. This feeling of comfort, however, strips away the benefits of a well-diversified portfolio.

Relative to the global equity market, Canada's main index is very top-heavy towards banks and natural resources: Financials (32.8%), Energy (16.0%), and Materials (10.7%). Being fully invested in Canada creates an over-concentrated portfolio; in other words, "all eggs in one basket." To avoid this problem, investors should seek diversity in foreign markets.

Let's talk about the S&P 500

When it comes to global markets, the S&P 500 is most referenced – a US market priced in US dollars. After all, the US dollar is the world's reserve currency and deservedly merits attention. This attention creates a constant stream of American-centric market headlines, ultimately building up one's sense of US "familiarity." However, as a Canadian investor, the S&P 500 performance should not be considered in absolute US dollar terms. The minute you invest in foreign markets, you introduce currency risk into the portfolio.

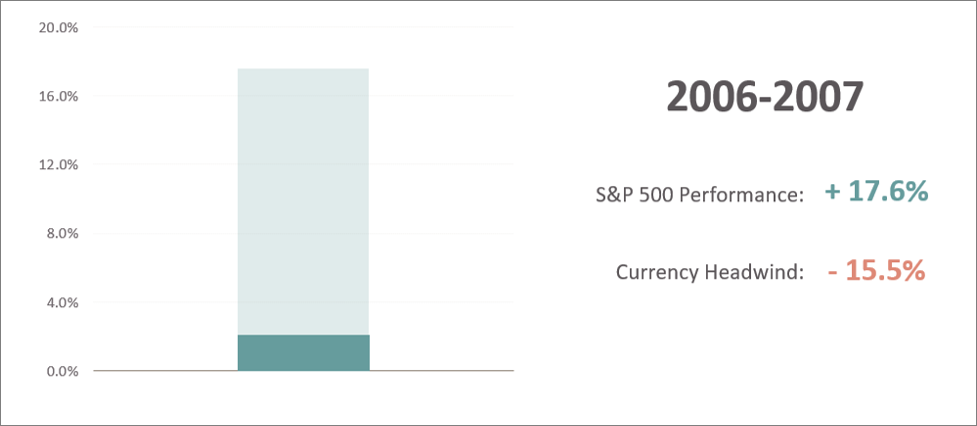

Using the US as an example, from 2006 to 2007, investing in the S&P 500 returned a healthy 17.6%. However, during that same period, the US dollar depreciated against the Canadian dollar by 15.5%. As a Canadian, your investment in the S&P 500 is made in US dollars, exposing you to USD/CAD foreign exchange risk. After the currency headwind, your total return as a Canadian investor – an uninspiring 2.1%.

While this example presents currency as a headwind, it is important to remember that currency can also act as a tailwind.

“Losing reserve currency status is not going to make the US dollar go through the roof. ”

Sharon Watkins, OUTLOOK 2020

Bottom Line

Currency matters!

Being aware of currency fluctuations can significantly impact portfolio performance. And this applies to all markets and currencies outside of Canada, not just the US.

It just so happens that the US dollar enjoys reserve currency status. And with the status, follows artificial demand. More and more, we are witnessing cracks in America’s global dominance.

Always remember, you can be right, AND wrong, at the same time. To hedge this risk, we reduced our portfolio exposure to the US dollar, invested in multiple currencies and increased our exposure to gold.