Growth of Alternative Investments

In an ever-evolving and increasingly complex market environment, Alternative Investments are playing a bigger role in asset allocation. A concentrated portfolio focused exclusively on stocks may work well on the way up, but it can handily eliminate your entire worth on the way down. Private Alternative Investments are less correlated with the public markets, and less influenced by what the Fed is saying and geopolitical risks.

At SANDSTONE, Market Alternatives have always been a part of our asset allocation. However, recently we increased our Market Alternative allocation while reducing traditional fixed income.

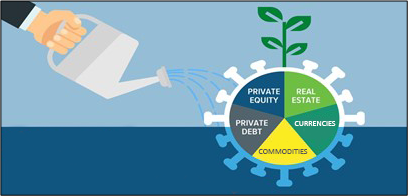

Market Alternatives include:

- Commodities – gold, silver, etc.

- Real Estate – rental, farmland, etc.

- Cryptocurrencies – bitcoin, ethereum, etc.

- Private Debt – off-market lending.

- Private Equity – direct investment in start-ups and early stage.

Alternative Investments are supplemental strategies to traditional equity and fixed-income investments. Because Alternative Investments tend to have a low correlation to traditional investments, adding them to an investment portfolio can provide the following benefits:

- Diversification with greater risk-adjusted returns.

- Reduced portfolio volatility.

- Hedge against inflation.

While there are many different types of Alternatives, client suitability is of utmost importance. Liquidity, time-horizon, risk-to-reward and management are a few key attributes we consider when evaluating opportunities.

Relationships are at the core of our private Alternative Investment Strategy. We must know the counterparty we are investing with, their track record, and their future business outlook. Since opportunities often come with little to no liquidity until the investment term is complete, we are looking for confidence that management can deliver results.

Where possible, we sit as an observer on their Board of Directors. In some circumstances, we will sit directly on the Board of Directors with no compensation, eliminating any conflict of interest that a paid Board member may find themselves in. This allows us to gain valuable insights into the company, their management, and the business outlook.

SANDSTONE’s existing relationships and institutional status allows us to invest alongside pension funds, Silicon Valley icons, and local private companies among others.

A few of SANDSTONE’s private Market Alternatives include:

- Calvert - a local Mortgage Investment Corp (MIC) with annual liquidity that yields 9-12%.

- BOLD - a Silicon Valley basket of companies within our exponential health theme.

- Lending Ark - an Asian Pacific (ex-China) short-term fixed income vehicle financing receivables yielding 6-9% annually and paying quarterly.

- InterGen - support for local companies that have opportunities to scale globally in our core themes.

bottom line

At SANDSTONE, we consider Alternative Investments a fundamental building block of a well-constructed portfolio. With low correlation characteristics, the asset class provides a modern-day hedge that lowers volatility and provides opportunities for better long-term risk-adjusted returns.