As we hurtle towards the familiar holiday hullabaloo and year-end tax planning, looming changes to the Alternative Minimum Tax (AMT) means that, come January 1st, you may no longer receive full deductions and tax credits for your charitable contributions.

Setting up a foundation through the Canadian Revenue Agency (CRA) is a viable option but, realistically, it would take months (or up to a year), not to mention thousands of dollars in legal fees, before you can reap the full tax benefits. Since time is the one commodity we never seem to have enough of, this may not always be the best route. But all is not lost. There is another brilliantly simple, flexible, and tax-advantageous way to gift to your favorite charities: Donor-Advised Funds (DAFs).

UNDERSTANDING DONOR-ADVISED FUNDS

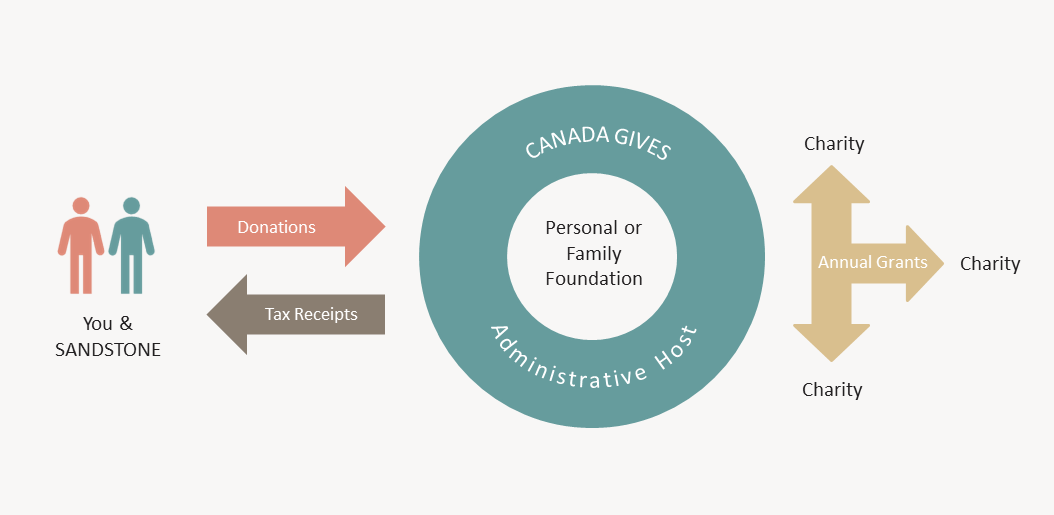

A Donor-Advised Fund is a charitable giving vehicle that allows individuals, families, and corporations to make tax-deductible charitable contributions to a fund, which is then invested by a portfolio manager, i.e. SANDSTONE. Donors immediately receive an official donation receipt and can request how the money in the DAF should be distributed to qualified charities of their choosing, making it easier to manage and track charitable giving over time. DAFs provide an attractive alternative for investors to engage in strategic philanthropy without the administrative burdens or sluggish timeline associated with creating a new foundation, and are currently one of the fastest-growing philanthropic mediums in the United States and increasingly popular throughout Canada.

Source: Canada Gives

To investigate the surge in DAFs as a relatively new giving avenue in Canada, we had the privilege of sitting down with Denise Castonguay, CEO and founder, and Ian Currie, regional development manager, of the charitable foundation Canada Gives. Here are a few key takeaways from our conversation.

WHAT ARE THE BENEFITS?

Time Sensitivity

DAFs can be set up and active in a matter of days (instead of months) and provide a swift, straightforward way to make a positive impact on the charities closest to your heart without the time-consuming process of establishing and managing a private foundation.

Immediate Tax Deductions

One of the primary advantages of contributing to a DAF is the immediate tax deduction. When donors contribute to the fund, they receive a tax receipt for the full value of their donation, allowing them to claim a deduction in the year the contribution is made.

Flexibility and Freedom

For prospective philanthropists, DAFs offer the same funding choices and executive privileges as traditional private foundations but with lower administrative costs and far greater flexibility. Given the done-for-you nature of these funds, it’s no wonder DAFs are taking the country by storm. They help you avoid the complexities of legal compliance and reporting, conduct due diligence on each charity, and manage all your donations and accounts, including the tracking of receipts. What particularly caught our attention is how Canada Gives’ investment policy allows the portfolio manager to maintain control of the funds. In other words, unlike with other DAF providers, we still manage your money. You and your family or organization simply need to select the charities you wish to support and let SANDSTONE and Canada Gives handle the rest.

Engaged or Anonymous Altruism

Contrary to traditional private foundations, where financial records are publicly available through the CRA Charities Directorate, the charitable foundation that houses a DAF is not disclosed to the public. Donors maintain the option to display their contact name and address to each charity, or withhold it and stay anonymous if they prefer to be a private philanthropist. But DAFs aren’t necessarily void of personal connection – nor do they signify an erosion of control. You can still engage with your chosen charities, gain appropriate recognition, and make disbursement decisions.

Strategic Philanthropy

One of the DAF’s greatest appeals lies in its ability to empower donors to take a more strategic approach to maximize the impact of their charitable giving. For example, combining two or more years of donations into one year or claiming them on the higher income spouse’s return. Investors can contribute to the fund when it's most tax-advantageous and then distribute grants to their preferred charities – even if those loyalties change in accordance with your interests and priorities over time. Whether your giving goals are to support one charity over a period of years or vary the recipients of your gifts from year to year, a DAF will free up your time to focus on what really matters, knowing your philanthropic passions are taken care of.

Legacy Planning

Finally, DAFs offer an opportunity for individuals to involve their families in their charitable causes, engaging children or other heirs in the decision-making process, and ultimately creating a legacy of giving. Additionally, building a sustainable funding base will allow you to not only meet the immediate operational needs of your chosen charities, but also fuel year-over-year, scalable growth.

BOTTOM LINE

In light of the impending changes to the Alternative Minimum Tax in 2024, Donor-Advised Funds emerge as a viable charitable giving vehicle. Their ease of set-up, immediate tax benefits, efficiency, and flexibility make them an ideal choice for those seeking professional management without the associated administrative and regulatory responsibilities. Importantly, Canada Gives’ DAF seamlessly integrates into SANDSTONE’s services, providing an additional option for managing your portfolio.

If you have any questions about DAFs or would like to set up a meeting to learn more, please give us a call. Philanthropy is one of the pillars of SANDSTONE, and we would love nothing more than to empower our clients to maximize their impact and leave a lasting legacy of giving.