Since the fall of 2020, Canadians have been able to benefit from a 1% prescribed interest rate, providing a significant opportunity to split income with a spouse or common-law partner, or other family members. With this rate doubling to 2% on July 1, 2022, individuals who are not currently taking advantage of this low rate, may want to consider it.

How can I benefit from the 1% Prescribed Interest Rate?

The prescribed rate on loans is used in conjunction with an income-splitting strategy for families with high-income and lower-income family members. The higher income family member can loan funds to the lower-income family member who uses the funds to generate income, such as through an investment account. The loan’s interest rate must meet or exceed the minimum prescribed rate, which is currently 1% and interest is payable annually by January 30 of the following year. Income splitting strategies can be used between spouses or with their children via a family trust.

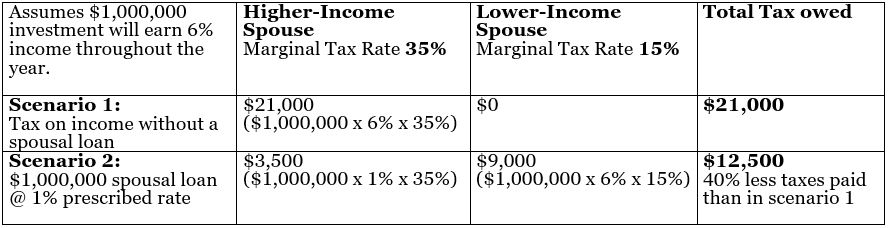

Tax savings occur as the lower-income family member has a more favourable tax rate and is taxed on the income generated from this loan. While the higher-income family member pays tax on the interest received from the loan which is expected to be lower than the income generated on the funds loaned.

Example of Tax Savings

Below is an example of potential tax savings for a couple where the higher income spouse has $1,000,000 available to invest.

bottom line

Individuals can lock in the 1% prescribed rate if the loan begins by June 30 and enjoy this low rate throughout the duration of the loan without being affected by any future increases.

We have set up many of these loans over the years and encourage you to give us a call if you are interested in finding out how a prescribed loan rate can reduce your tax bill and benefit your estate plan.