Vietnam is a market that is largely overlooked and under-owned by the average investor. Why is this the case? It is a relatively small country in size, not a major power engine of the world and is considered a frontier market.

Unconventional and off index investments can provide enhanced diversification benefits when valuations are relatively undemanding, there is growth potential and correlation to the overall market is low.

What is the investment case for Vietnam?

Government Stability

Vietnam is a socialist republic and under single-party rule. Its government has been constant and steady for over 40 years and the country is one of the more stable in the ASEAN region.

Strategic Location

Located in the center of the ASEAN region, it is close to all major markets in Asia, the most notable neighbour of them being China. Its long coastline, direct access to the South China Sea and proximity to the world’s main shipping routes give perfect conditions for trading. Port Lach Huyen opened in 2018 and is Vietnams first deep-sea port accommodating large vessels – thus avoiding stops in Hong Kong and Singapore for international freight transport, saving about one week in shipments.

Open to Trade

Vietnam has promoted its economic growth through both trade and membership agreements, making it a more liberal market.

Some membership and agreements include:

- Member of ASEAN and ASEAN Free Trade Area (AFTA)

- Member of the World Trade Organization (WTO)

- Bilateral Trade Agreement (BTA) with the US

- Free Trade Agreement with the European Union

- Comprehensive and Progressive Agreement for Tans-Pacific Partnership (CPTPP)

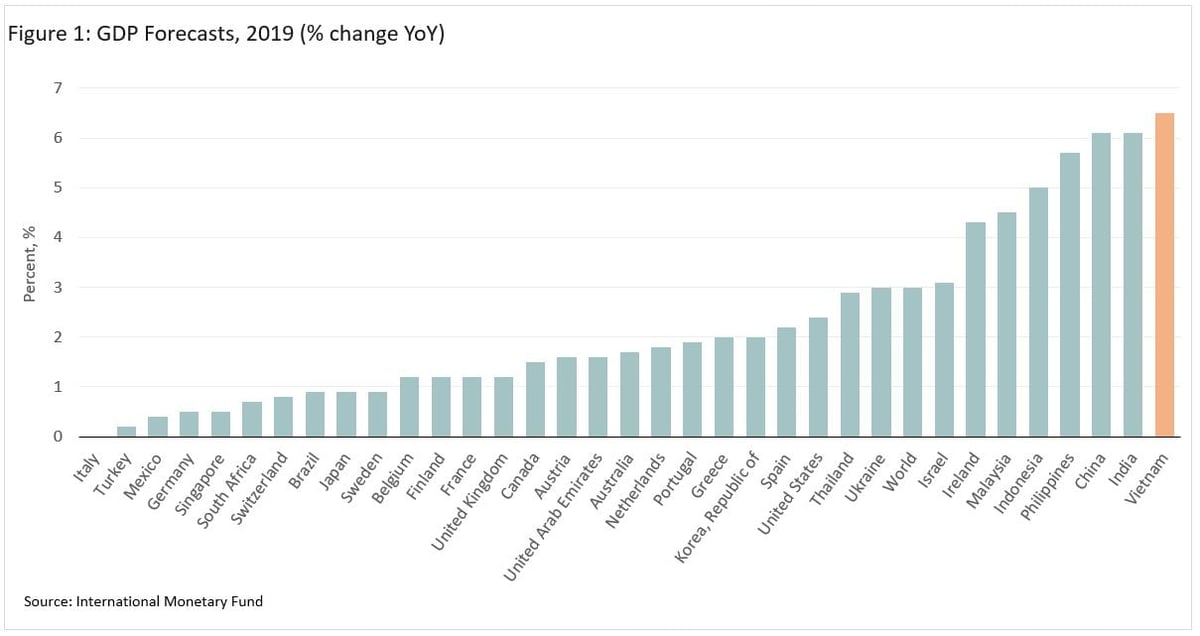

Stable GDP Growth

Over the last few decades, Vietnam's economic growth has been one of the fastest in the world. This rapid development started due to economic reforms launched in 1986 and the rise has been continuous ever since. Historical five-year GDP has averaged 6.6%. According to the World Bank, the economic growth of Vietnam has raised the country from one of the world's poorest into a low/middle-income country over the past three decades.

Foreign Direct Investment (FDI) is Welcomed

Vietnam encourages FDI by constantly renewing regulations and providing investment incentives in certain geographical areas and sectors of special interest (i.e. high-tech, healthcare etc.) In 2016 Samsung, Nestle and LG were the country’s largest corporate investors. Currently, Asian countries represent the lion’s share of FDI into Vietnam; Hong Kong leads with approximately 30% of investment in the first half of 2019, followed by South Korea, Singapore, China and Japan. China has been increasing its investment in Vietnam rapidly moving from 7th largest investor to 4th in a few short years – this can partly be attributed to the US-China trade war and China shifting from manufacturing to a value-add economy.

Export Growth

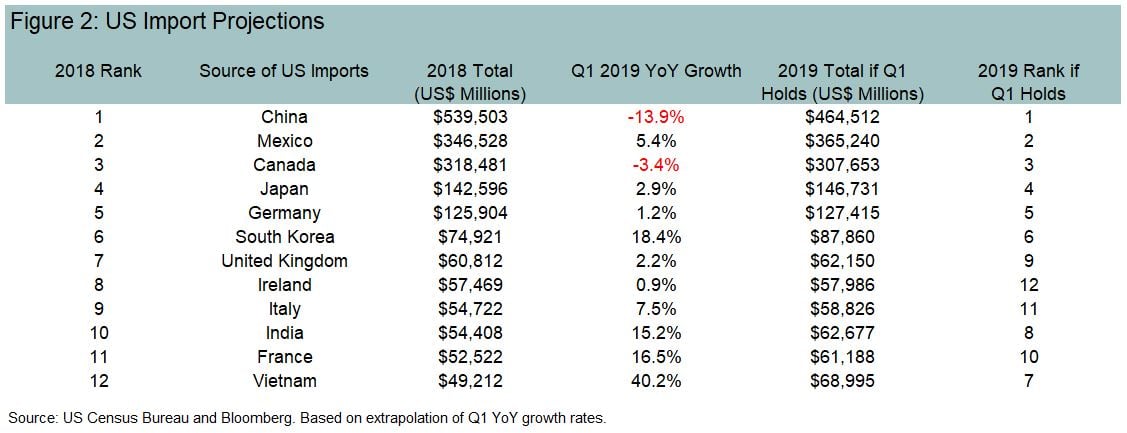

Manufacturing locations and supply chains have been materially altered due to tariffs and revamped trade. Vietnam has become one of the fastest-growing sources of American imports, jumping 40% in the first quarter of 2019, during the same time Chinese goods dropped by 13%. If this keeps up for the remainder of the year, Vietnam could surpass the UK as one of the biggest suppliers to the US, according to Bloomberg.

Competitive Labour Costs

Rising labour costs in China have forced manufacturers to look for alternative lower-cost markets, giving Vietnam a good opportunity to become the next hub for manufacturing. Vietnam has a competitive wage structure which is less than half of the average wage in China.

Strong Demographics

With over 95 million in residents, Vietnam ranks as the 14th largest population in the world. The population's median age is approximately 30 years with an estimated 60% of Vietnamese under the age of 35. In addition to the workforce being young and large, the country invests more in education than other developing countries. Over 93% of the population is deemed to be literate and Vietnam ranks close to German in mathematics, reading and scientific grades and above the US and the majority of Western Europe.

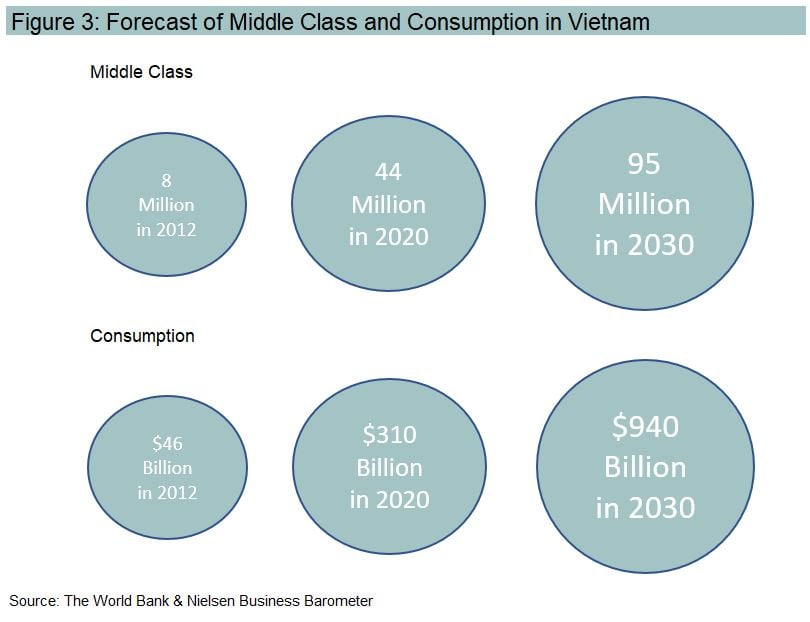

Rise of the Middle Class

Vietnam’s middle class as a percentage of the population is increasing faster than any other Southeast Asian Nation. A steadily increasing economy means bigger income resulting in a growing middle class, thus supporting consumerism.

Bottom Line

When you compare basic economic fundamentals, Vietnam fares better than many of their Western counterparts with greater GDP growth, competitive labour costs, better demographics and location to markets. Vietnam is growing into one of the most dynamic emerging countries in the ASEAN region.

SANDSTONE’s exposure to Vietnam is through Dragon Capital’s closed-end fund Vietnam Enterprise Investment Limited (VEIL). VEIL is the longest running fund focused on Vietnam and one of the largest which invests primarily in listed and pre-IPO companies offering attractive growth and value metrics, and strong corporate governance. Our initital investment was executed at an approximate 12% discount to its net asset value (NAV).